I make many New Year resolutions every year and quit most of them in January itself. But I don’t regret it because when I realize even the ones that I have stuck to have changed my life beyond imagination.

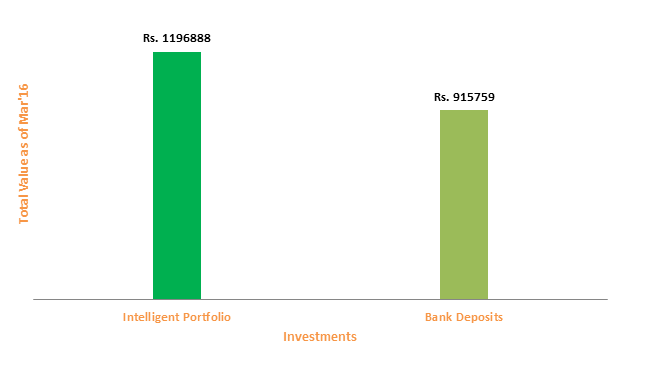

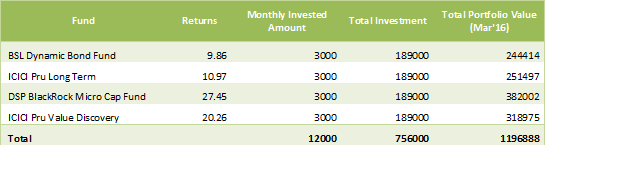

One such promise I made myself 3 years back was to give away and invest part of my income every month. I started investing Rs 7000 a month. When I look back I think that it has been one of the best decisions I ever made in these 3 years. It has given me a return of little short of 22% annually.

From my experience I realized that:

- Your expenditure may give you instant happiness, but saving and investing will help you in your every financial troubles and needs in the future. (Right from a cash flow trouble to enhancing your lifestyle in the future). It’s like a parachute for you so you can jump with craziness!

- Saving is a discipline and once you get into the habit, it will work for you. The clothes you impulsively buy every month will stop entertaining you in a few days or months, but your investments will ensure that buying things that make you happy always increases and doesn’t end.

- Investing your money gives an entrepreneurial spirit. Here I am putting my capital to work for me. I can imagine that whatever small amount I am investing goes into a few businesses.

- And last and most important, it makes me richer every single day. I don’t think I love my capital as much as I love the money that is earned from that capital.

Giving money give us a real satisfaction but investing and watching your money grow is more than satisfying. It is a great feeling to put your money to work. I think that is a feeling every investor in this world chases!

Now even if I continue investing those Rs 7000 every month for the next 22 years and I get an average annual return of 15%, do you know how much I would have at the end of that? Rs 2.3 Crores! Yes the elders said it right. Drop by drop make an ocean!

When it comes to New Year resolutions, making one is easy but commitment is difficult. So it’s also important to set achievable goals. Start with small. Having said that, here are a few other goals you could set to gift yourself a better financial future:

- Start an emergency fund: A good start could be a fund that amounts to 3 months of your income. You never know when a rainy day comes and you need some money.

- Invest in your retirement: The Rs 7000 that I am investing. It’s never too early to start and as a matter of face, the early the better.

- Know your investments: How many times we invest money in what we really don’t know about. Putting money in insurance products when it’s not your need or time. Every human being is different and has different circumstances. Know your needs and know your investments to get the best outcome.

So when you enter 2017, enter with a spirit of getting wealthier, putting you money to work for your future financial goals and with a sense of gratification it provides.

Saving only isn’t enough. We need to put that savings into smart investments to get the desired outcome. But for now enjoy the last weekend of 2016 and get back here again to know to learn about intelligent investing.